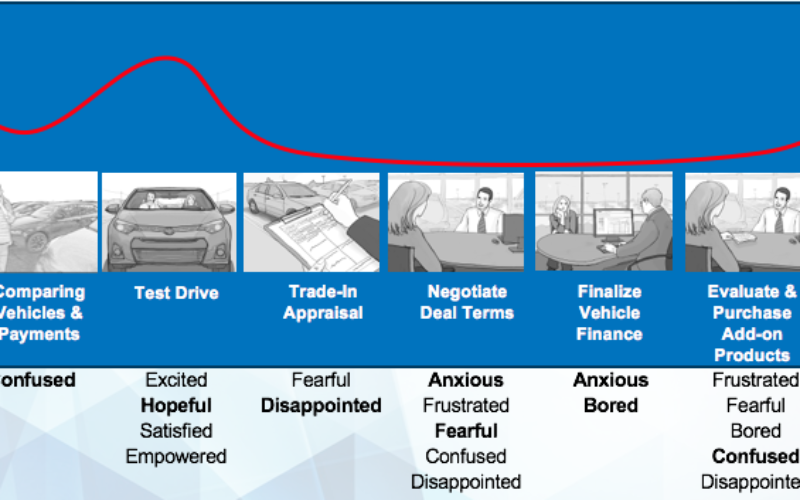

Eight steps of the sale evaluated with the emotions most frequently used to describe each step. Used with Permission of Cox Automotive ©2016

The complexities of automotive retailing are well-known. Starting with merchandizing all the way to delivery, getting a car into the hands of a customer and watching them drive off the lot happy and satisfied is a tremendous amount of work. Their decision to finalize the deal is fueled in large part by the vehicle but more and more, the experiences they have in the dealership are becoming a more important aspect of the sale.

From the customer’s perspective, different emotions are in play depending on where they are in the process. In fact, emotions can swing substantially while buying a car. In most cases, you won’t see many visual cues yet more and more, we’re finding that these emotions are what drive purchase decisions or cause shoppers to leave before the sale. Understanding what events or points in the process potentially trigger positive or negative emotions can help dealerships adjust their strategies and processes and make the experience less “painful” and more enjoyable for them—and profitable for you.

Cox Automotive hired Root & Associates to gain new insights into new and used car buyers and the emotions associated with steps in the sales process. We examined the experiences the dealer has control over so we focused on the part of the buying process that typically happens while they’re at the dealership. This includes engaging with a sales person to delivery of the vehicle. The insight can be used to develop products that improve the overall consumer experience while shopping for a vehicle.

Using an advanced question strategy called competitive topography, we asked participants to rate positive feelings or attributes like “excited” and “hopeful” and negative attributes like “fearful” and “anxious” to ten specific steps of the car buying process. These steps included “comparing multiple vehicles and payment options before making a final selection” and “finalizing vehicle financing after negotiating the deal.” Competitive topography gives us rich 2D visual mapping of the points and all of the emotional attributes both in absolute relation and comparing the emotions across all of the steps.

Our participants had bought a new or used car at a franchise car dealership within the last 6 months so their recall and memory was considered fresh. For most steps in the buying process, consumers are generally satisfied, hopeful and excited. This is good because it shows they view the process of getting a new car with mostly positive emotions, making it an exciting and enjoyable experience.

The steps that are associated with the highest positive emotions such as excitement and satisfaction had to do with the interacting with the vehicle. This includes the test drive and, not surprising, taking delivery of the vehicle. Delivery had the highest empowerment, excitement and satisfaction ratings, and the lowest disappointment and fear.

At the other end of the emotional spectrum, we expected the negotiation to have relatively high ratings for anxiety, fear-inducing, confusing and disappointing. But what is surprising is that it wasn’t the most negative part of the process for most people. For this group, the step that elicited the strongest negative emotions was evaluating F&I and other add-on products.

Evaluating F&I products emerged as the most frustrating step and ranks very high in confusion, disappointment, fear and boredom. Used with Permission of Cox Automotive ©2016

And it makes sense. They’ve just arrived at what should be the end of a long process. They’ve test driven the car, negotiated the deal and terms and they’re now told they’re going to work with the F&I Manager to finalize the bank paperwork. They’re relaxed and coming down from some anxiety around finalizing the negotiation. And then they’re hit with a sales pitch for add-on products they don’t understand and haven’t had time to research. Frequently these are sold by pointing out all that can go wrong with the vehicle they just agreed to buy before they have even taken ownership of it.

For many, it’s a mental sucker punch at the end of a long experience. And it comes right before the most enjoyable part of taking ownership. Talk about an emotional roller coaster. So what should dealers do? Here are three suggestions that can take the sting out of F&I while still giving your dealership opportunities for additional gross.

1. It’s more important than ever that dealers be transparent in providing consumers with information about pricing and payment as early in the process as possible. Consumers do much of their pricing research online across multiple devices, so help them complete their F&I education (definitions and cost) in advance by providing resources on your website. This way, they can feel knowledgeable and more prepared prior to arriving at the dealership.

2. Don’t save it all until the very end. Utilize some of the in-dealership waiting and idle time that is inevitable throughout the process to give your customers information about add-on products that are designed to protect their investment they can read at their leisure. This can be on paper, on a tablet or on your website.

3. Have your sales staff trained and ready to discuss the F&I add-ons at any time—not just in the F&I office.

Cheers,

Kevin