The auto industry “is the most disrupt-able business on earth,” says Morgan Stanley lead auto analyst Adam Jonas. One reason is, cars are a massively underutilized asset. For most people they represent the second largest expense after their home, yet that investment sits idle about 96% of the time.

In the past, the main alternatives to driving yourself for getting around town were public transit, getting a ride from a friend or hailing a taxi, but that has changed. For many people today, a fast and efficient door-to-door transportation option can be summoned by using your smart phone. Uber has ushered in the TaaS (Transportation as a Service) age, and it's already estimated to be a 1 trillion dollar industry. This has people considering alternatives for their idle vehicles such as car sharing using services like Relayrides.com, but more importantly, it has many people reconsidering ownership as a whole. If they own three cars in their household, can they reduce it to two? Will they go from two to one, or go from one to zero and move from vehicle ownership to simply purchasing transportation on demand?

These are the foundations of change as people begin to shift their thinking away from ownership and toward purchasing mobility. And the auto manufacturers are quietly adjusting their thinking in this direction as well. New mobility, car sharing, ride sharing– “what does that mean for us?” “We’re thinking through that” said Mark Fields, Ford’s Chief Executive at a recent investor conference. “We are thinking like a car and truck company, but we are also thinking like a mobility company.” Ford is preparing to conduct peer-to-peer car sharing trials in which owners could rent vehicles for short-term trips, similar to models run by Zipcar and operating or in the works at rival automakers.

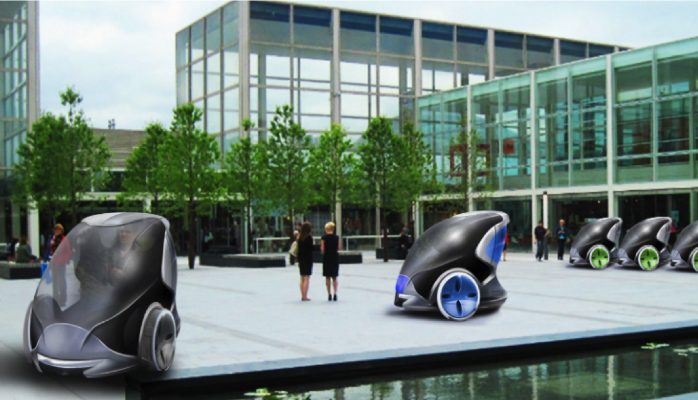

Toyota is actually testing car sharing in Grenoble, France where residents can rent electric cars for short trips. In the U.S., Toyota is offering a membership service to buyers of its small Scion vehicles. They can borrow a Toyota truck, van or hybrid for 10 days in their first year of ownership. Yes, manufacturers are preparing for the shift to shared mobility.

Much of this, however, is the precursor for the real disruption that comes with the advent of fully autonomous self-driving cars. Before you dismiss that concept as something in the distant future, consider this:

Fully autonomous, self driving cars are being tested now. Google has approximately 50, about half of which are purpose built prototypes currently driving around Mountain View, California and other cities. Their fleet has already driven over 1.1 million miles in autonomous mode and they are currently logging over 10,000 autonomous miles per week on public streets.

Google is not alone in this pursuit. As has been widely reported in the media, Uber, Tesla and Apple are all working on driverless vehicle technology. But the manufacturers are in the game as well and have a variety of projects quietly underway now, centered on either semi-autonomous or fully autonomous technologies. The ability to get from one place to another- faster, less expensive, more conveniently and safer- is a powerful draw.

“Transportation tech” is in full swing and with it lies the real potential for industry disruption. The combination of a shift in public thinking from vehicle ownership to purchased mobility propelled by economic savings and coupled with the convenience of fully autonomous self driving cars may be too powerful a value proposition for many to resist. This would be the new era for the auto industry and all those who support it.

With that new era comes massive change. Some of that will be devastating for existing long term businesses, however, as with every major industry transformation, there will be opportunity for innovators and those willing to change and adapt.

It is clear that the auto industry will go through a significant evolution and that it will begin sooner than many expect. As I got deeper into this subject I was taken back by the far-reaching impacts that are likely to occur across multiple industries (insurance, fuel, infrastructure, transportation) and wanted to assemble some of the key findings for others to review, consider and debate.

I have compiled a 70+ page report that is a summary of those findings, along with links and citations to several other leading studies and articles on these subjects. I have omitted my editorial so that you can draw your own conclusions. I was not able to link that PowerPoint to this post, but it can be viewed/downloaded from my LinkedIn profile page (click on my name above) if you are interested.

Cheers.