Here are samples of projects we have driven. These samples are used with permission or are in the public domain.

Root & Associates designed and executed a large qualitative and quantitative study for Marchex uncovering the impact of how quality communication, transparency and trust lead to car sales today. Get the Executive Summary here or see the “research summary video” tab for more.

Not only do we help clients with research but also with developing media content to raise their brand awareness. View an article from AutoDealer Today we co-authored on the Marchex research.

Root & Associates was retained by an investor group to help evaluate replacing and updating the Costco Auto Buying program.

Example of utilizing proprietary qualitative and quantitate research by Root & Associates for product concept validation. Read results in their white-paper summary.

Cox Automotive COO Mark O’Neil references Root & Associates study for thought leadership purposes at the 2017 Automotive Forum.

Root & Associates can help you maximize your research investment in a variety of ways. We have experience ranging from strategic planning to product and industry awareness.

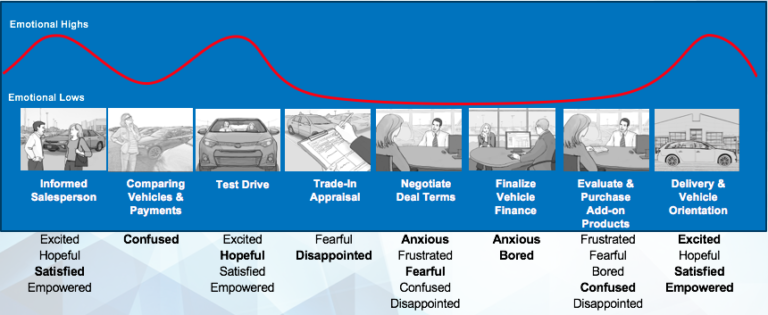

Consumer Experience Research, 2015: DrivingSales

Providing a quality customer experience is a key differentiator for new car dealerships. This research set out to understand the importance of consumer experience, what shoppers expect and how an optimal experience positively impacts dealership business.

Keynote at Driving Sales Executive Summit & Presidents Club

Key stats:

3 out of 4 consumers used 3rd party websites while shopping while significantly less used dealership websites.

61% first mode of contact was to physically visit the dealership emphasizing the importance of the dealership visit

43% of people will leave a dealership if personal information is needed to get a purchase price

Research methodologies:

Qualitative and Ethnographic Interviews

In-Dealership Shop-a-longs

Quantitative Survey

Principle Component Analysis

Conjoint Analysis

2012 Dealer.com in partnership with DriverSide and GfK

With social media channels adoption officially mainstream, this research showed the significant influence of social media channels, Facebook on car shopping and specifically dealership and vehicle consideration. Inspired by McKinsey & Company’s Consumer Decision Journey, the research showed the automotive purchase process was cyclical and heavily influenced by the advocacy of friends and family – both positively when people recommended a vehicle or dealership – and negatively.

Key stats:

27% of car shoppers who use Facebook have or will use it as a resource for shopping for a new vehicle

41% of those that used social media said they saw a post that caused them consider a new brand or model

25% of the car buying population feels social media has a significant influence on their purchase decisions.

Research methodologies:

Quantitative Survey

Qualitative Interviews

2010: DriverSide in partnership with R.L Polk

Keynote at Digital Dealer 2010

In 2010, deep in economic downturn, consumers were postponing purchasing new cars. With more older vehicles on the road, demand for service was a natural consequence yet dealership service departments were losing valuable business due to distrust and perceptions of overcharging. This research looked closely at the perception of dealership service departments and how service management can better connect with consumers to build service appointments and increase dealership service revenue.

Key stats:

66% felt that dealership service departments were most likely to overcharge

53% felt that locally owned repair shops would provide the best value for their money

Results for new car dealerships implementing optimal service marketing showed a 27% increase in service frequency and $107 increase in annual revenue per customer

Research methodologies:

Quantitative Survey

Mystery Shopping

Dealer eBusiness Performance Study: The New Buying Influences, 2007

The Cobalt Group, in partnership with Yahoo! and R.L. Polk

In 2007, when online consumer reviews were still used mostly used for restaurants, we set out to understand dealership Internet lead handling and the impact of search and consumer reviews on vehicle shopping and purchasing. Widely cited by many in the automotive industry, we were the first to advocate for embracing and nurturing consumer reviews as a powerful marketing channel for both new business and to build loyalty.

Key stats:

55% of vehicle 3rd party leads resulted in a sale of a new or used car

43% used consumer ratings and reviews to select a dealership

73% said they would use dealership reviews and rankings for future vehicle purchases.

A conjoint analysis showed that consumers valued a good buying experience nearly as much as the lowest price of a vehicle and were sometimes willing to forgo the lowest price for a better dealership buying experience

Research methodologies:

Quantitative Survey

Conjoint Analysis

Internet lead-to-sale Analysis of 1 million leads

Mystery Shopping